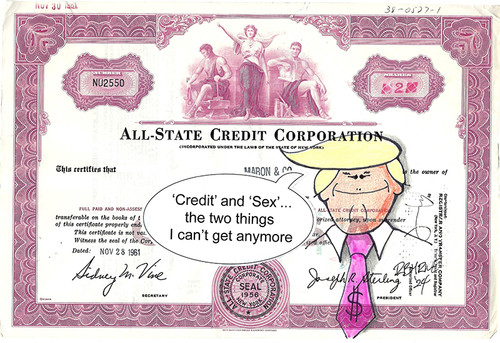

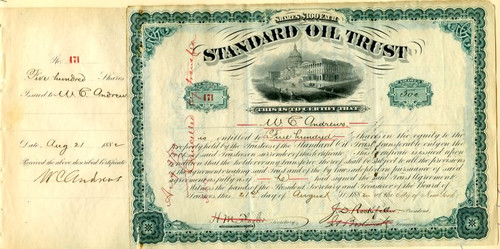

United States Credit System Co. - Newark, New Jersey - 1891

Was:

$99.95

Now:

$79.95